The Utah Housing Market

Just how turbulent is the Utah housing market right now? Ask any Salt Lake City area homeowner, and you’re likely to get an earful about how the Utah housing market has changed in the last 3 years. Home prices have been since the dip in prices about 24 months ago. Fast forward to the Spring of 2025 and home prices are inching down the last 9 months which can happen the last half of a given year. Affordability is still a huge concern. It really boils down to supply and demand. Interest rates have now started slowly fall. Hopefully this is a trend over the next year or so.

Home sales have certainly slowed from the peak about 2 1/2 years ago. The amount of time it takes for a house to sale has increased in the last year which means there are more homes for buyers to look at. Those buyers also do not need to be in such a rush to make an offer since competition is much lower because of fewer buyers in the market. However, the demand for housing remains strong with people moving into the state and our children growing up, getting married and needing housing. While interest rates may be keeping these young buyers away now, a small shift down in interest rates could bring a lot of buyers back to the market including buyers that have been sitting on the sidelines.

Supply and the Utah Housing Market

The supply of homes available for sale (number of homes listed) seems to be leveling out since mid 2023, and the number of homes sold seems to be back to normal seasonal changes. Currently, the number of listings is increasing as we move into spring and summer. People that have a rate in the 2.5 to 4 percent area are hesitant to sell because their rate on a new mortgage will be much higher. Another factor of low home supply is that builders have, once again, reduced the number of housing unites they are building. This also happened for several years after the economic crash of 2008. The total number of housing starts, including the Utah housing market, started to decline in 2006 and bottomed out in 2010. More on historical housing starts here. We have had a growing population with slowing home building since 2005.

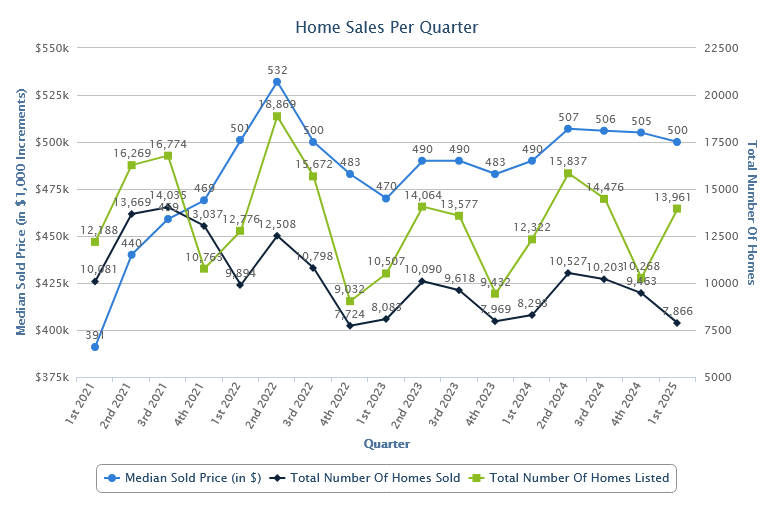

In the first nine months of 2024, the Utah housing market characterized by a gradual increase in home prices, number of listings increasing and the number of homes sold slightly increasing. This trend has started to change with the time of year. You can also see by the graph above that the median home price increased from $490,000 in the 3rd quarter of 2023 to $507,000 in the 3rd quarter of 2024. This is certainly not a favorable trend for home buyers from the stand point of high interest rates and rising prices; however, there is less competition for what houses are available for sale.

The first quarter of 2025 has seen home prices slightly going down and number of sales decreasing.

While buyers are having a harder time qualifying for higher mortgage amounts and higher interest rates, those buyers that do qualify have more homes to chose from. Homes that are priced right and in great condition are still seeing competitive bidding for the home. Add into the mix that most buyers have to sell a home to buy their next home, and things can get super busy. Professional cleaners, moving companies like Rocket Moving, and landscape companies can help you keep your busy schedule caught up.

Typically, this would be the sign of a resilient and confident economy. And Utah certainly knows a thing or two about both resilience and confidence.

What about Utah’s demand for housing? Like most of the country, the demand for housing is high in Utah. What are some things that drive the demand side of housing in Utah?

Demand and the Utah Housing Market

The “Silicon Slopes” And The Tech Boom In Utah

Compared to other states of similar size, Utah’s economy has never particularly lagged or faced drastic underdevelopment. Even at the height of the 2007-2009 recession when Utah homeowners saw an estimated $25 billion loss in equity, we were able to weather the storm relatively unscathed. Not just unscathed, but healthier than ever. Even in the current face of economic uncertainty as inflation seems to be harder to get under control than previously thought by economists, Utah’s unemployment rate was only 3.2 percent in February of 2025; it is lower the national rate of 4.1%.

But for a long time, very few people would have ever referred to Utah as an “innovation” state. In fact, it wasn’t what you’d call a national player on the economic stage at all. We may have some of the best ranked schools in the nation; but if you were to ask someone from New York or Los Angeles to name Utah’s single most significant export, you might find yourself waiting much longer than expected.

That all changed back in 2007 with the publication of the State New Economy Index, which specifically named Utah as the top state in the nation for economic dynamism based on “the degree to which state economies are knowledge-based, globalized, entrepreneurial, information technology-driven, and innovation-based.” And people listened. More specifically, tech startups who found the low cost and relaxed pace of Utah much more accommodating for their needs than the over-saturation of San Jose or Palo Alto. As a result, Utah now plays home to what’s been affectionately nicknamed the “Silicon Slopes”; a multi-city hot-bed of technology and innovation including Salt Lake City and Provo, hosting key industry players including Adobe, Facebook, Northrop Grumman, Oracle and Cisco alongside major government initiatives such as the NSA’s National Data Center.

The impact on Utah’s housing market can’t be overstated. Not only has Utah been historically named one of the top states in the country for future job growth, but Utah’s housing price index skyrocketed from approximately 375 to well over 783 between 2007 and the beginning of 2023. However, the index has come down a little from the 2nd quarter of 2022. And that’s in spite of two recessions occurring in less than fifteen years!

Affordability, Not Cheapness: The Cost of Living In Utah

As of the end of March 2024, the median price of a single family home in Utah is $490,000 with forecasters predicting slightly higher median home prices through 2024. Let’s look at some of our neighbors. As of March 31, 2024, the current home value in Colorado is $546,004, while Nevada can command a much more affordable $443,453. All three states rely heavily on tourism as a major industry. So why is there such a dramatic contrast in home values?

The cost of living. Fortunately, Utah has a lower average cost of living compared to the rest of the country. Unfortunately? It’s not that much lower. According to a 2019 report from independent tax policy analysts the Tax Foundation, Utah only ranks number 28 in the country in costs of living, while Colorado and Nevada occupy numbers 40 and 30 respectively.

Recent statistics from the US Census Bureau indicate the median household income in Salt Lake County is $82,206. That’s a little over $13,000 more than Salt Lake City itself and over $10,000 higher than the national average!

Utah may be more affordable than the likes of Massachusetts and California, but that doesn’t mean it’s necessarily cheap. It’s a matter of perspective as well as an indicator of the economic diversity of Utah. And just because Utah is comparably isolated doesn’t necessarily mean anything less than a stark difference in income and cost of living. The average home for sale in a town like Alpine is reportedly over $1 million while a city like Provo has a median home value of approximately $457,303 as of March 31, 2024. Why such a drastic discrepancy in costs between two cities separated by only 19 miles? The median household income in Alpine is a little over $138,000, while Provo reports only $51,532.

But as the last few years have reminded us as we go through 2023 and into 2024, those numbers can change overnight.

The Coronavirus Pandemic And Utah

A good thing for the country and the world is that the Covid-19 situation is mostly characterized as a typical flu strain.

If Utah’s economy and job growth potential can be seen as a model for the rest of the country, then our response to the coronavirus pandemic is nothing short of inspiring.

But while both the decline in reported cases as well as our response to the pandemic may be admirable, it’s an understatement to state that it’s made us rethink our entire understanding of economic and industry factors. Not the least of which is our housing market in Utah. And Salt Lake City is an excellent example. Home sales suffered a sharp decrease in the third quarter of 2021 in our capital city that lasted about five months. Home sales started back up in early 2022 until interest rates climbed very fast around May of 2023. This started the decline in number of homes sold we see in early 2024.

Religious Affiliation And Utah Real Estate

Despite the increased focus on economic development and the tech boom, there’s one factor that’s virtually synonymous with Utah: the Church of Latter Day Saints (Mormons). Over 2.1 million Utah residents currently identify as members of The Church of Jesus Christ of Latter Day Saints—close to 70 percent of our entire population. And with over 5,200 congregations and over 15 temples in the state and growing, it’s fair Utah has historically been the very heartbeat of the LDS movement. But how does this affect the real estate market?

One way Utah is affected is the the people in this religion love to have large families, and many of the children of these large families want to stay in Utah and have large families. We have strong internal growth in Utah.

Tourism’s always been a key industry in Utah, drawing close to 14.6 million visitors in 2024 alone. But equally remarkable is the dramatic growth of LDS missionaries from around the world. And with the oldest and largest LDS Missionary Training Center centered in Provo, it’s only natural that adherents who find their calling in spreading the doctrine will look for housing within the state.

The Future Of The Utah Housing Market?

Not only do Utah’s children want to stay in Utah for the most part, people want to move to Utah putting pressure on the housing supply. Add inflation eroding spending power, and you have an interesting housing scenario.

Real estate is never a predictable industry, even during economic upswings. Demographics, job concentration, nearby amenities and tax rates are just a few of the chief factors that affect the national housing market. And they’re subject to change without warning.

What affects the national housing market also affects Utah’s housing market as well. We may be blessed with many things; natural beauty, a major highway like I-15 connecting otherwise disparate regions and some of the friendliest people you’ll ever meet. But there’s only one crucial difference between Utah and much of the rest of the country.

Our resilience. And that’s as true of Utah’s real estate market is it is of our general character. We’ve weathered recessions and economic downturns with sheer fortitude over the past few decades, and we’ll weather a public health emergency with grit and determination. It’s in our bloodstream.

And if you’re a Utah homeowner, it’s in yours too. But the unfortunate reality is that much like the rest of the country, you may also be affected by any number of circumstances that require you to sell your home fast. It’s never an easy decision, and we hope it’s one which doesn’t require you to move out of state. But what if there was a way to sell your home without actually having to move? At Gary Buys Houses, we offer exactly that. It’s called our “Sell Now, Move Later” program. We’ll purchase your home quickly at a price that’s fair—frequently, in as little as 3-5 business days. What’s more, we’ll allow you to stay in it as long as you need. We’ll even arrange to sell it back to you if you find yourself in a position to own your own home again.

We’re proud to live here in Utah. We’re proud to have you as our neighbor. And we hope that your future here is as bright and hopeful as you are.