Are you swimming in debt? Do you have a tax lien placed on your house? If you’re not sure what to do, how to get rid of the lien or know if you can sell your house with a tax lien, then read on to see all your options and start looking forward to a debt-free life today.

What Is a Tax Lien?

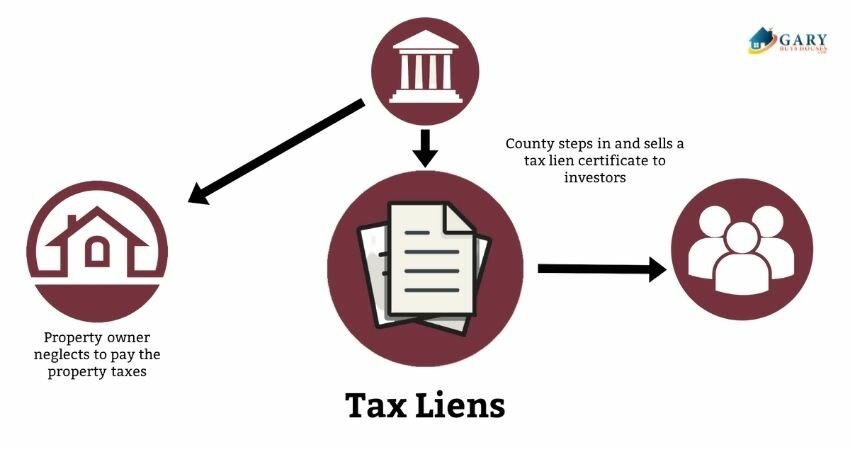

A lien is a third party taking a legal claim against your property because you owe that third party money. A tax lien means you have unpaid taxes and the government is the third party that has placed the lien on your property. A tax lien gives the government the right to force your property to be sold to satisfy the debt if you do not pay the debt owed.

There are three types of tax liens:

Property Tax Liens

If you do not pay your property taxes then a property tax lien can be placed on your home by the city or county government where you live. In Utah, for example, one can go 5 years without paying property taxes on their house before the house is sold at auction. But if this happens, you could lose a lot of your equity. So, I may want to sell my house with a tax lien on it to keep my equity.

Federal Tax Liens

Failing to pay your federal taxes means the IRS can place a tax lien against your home. If you own a business that has a payroll, the IRS can also lien your house for unpaid payroll taxes.

If you owe federal taxes then the IRS or local tax collection agency will send you a bill which will include any interest or penalties. If you ignore the bill then you’ll get at least one more bill in the mail, most likely with added interest and penalties. If you continue to ignore the bills then the IRS can take collection action. This could mean seizing your property and assets or a lien on your home. You can read more about it here.

State Tax Liens

Failure to pay your state taxes means the Utah State tax commission can file a tax lien against your home. If you own a business that has a payroll or sells products that are suppose to have sales tax collected on them, the State of Utah can also lien your house for unpaid state payroll taxes and sales tax due.

Can You Sell a House With a Tax Lien?

So what does that mean for you? If you have a tax lien on your home it’s in your best interest to pay the debt in full and quickly as possible. The fees on unpaid taxes can become exorbitant and make paying the debt much harder over time.

A lien will always be discovered during the traditional title search that takes place during a home sale process. Be up front with your realtor if you have a lien on your property so you can work together to sell the home and simultaneously clear the tax lien.

If you are unable to free up cash to pay off the lien then one option is to sell your home. If you have enough equity in your home then you can pay off the tax lien when you close on your property. Keep in mind the equity will also need to cover closing costs and the remaining mortgage balance. There are necessary steps to take to try to sell your home with a lien and use the equity to pay off the tax lien, so keep reading to see how the process works.

Essentially you have 8 options when dealing with a tax lien.

- Dispute the tax lien. In some rare cases a title search will claim that you have a tax lien on your home and it could be a mistake. A tax lien against someone with a similar or same name can cause this problem. If you have had a past tax lien that was paid off but is showing as unpaid then you can also take action to dispute the lien.

Disputing a lien is not simple and may require the help of a tax advisor to help you clear up the error and provide proof that there should be no tax lien on your home. - Request a certificate of discharge. There are situations where the IRS will grant a partial release of the lien or will grant a certificate of discharge which releases the property from the lien, allowing you to sell the house. You will still owe the tax debt but it will be tied to other assets or personal property, making it easier for you to sell your home.

- Pay off the lien at closing. A closing attorney will be involved to submit the funds from the closing to ensure that the lien is satisfied. The law firm will make the payment to the IRS in full and then the IRS releases the lien. With the lien satisfied the sale closing can be completed.

- Use a HELOC to pay off your lien. If you have equity built up in your home then you can see if you qualify for a HELOC to pay off the lien before selling the home.

- Wait for the debt to expire. With federal taxes there is a 10-year statute of limitations period, meaning that after 10 years you will be free from the tax lien and not have to pay it off. This is not a good plan to bet on however, if you continue to ignore the debt the IRS can actually file a suit against you to collect the money which will give them a judgment claim against you, removing the 10-year statute of limitations and requiring the full payment.

- Set up a payment plan. The IRS or local tax agency may be willing to set up a payment plan to help you pay off the debt over time.

- Request an offer in compromise. You can ask for an offer in compromise meaning you can pay part of your tax lien and be forgiven the remaining amount. You may not be granted the offer as the IRS will look at your income, expenses and assets to determine if they will grant the reduction.

- Declare bankruptcy. Chapter 13 bankruptcy means you’ll work with a judge to get a play for paying off your debts, usually at less than what you owe. Once your debts are fully paid then the lien will be satisfied.

Can’t Cover Your Tax Lien?

Are you thinking to yourself, “can I sell my house with a tax lien on it”? If you’re dealing with back taxes and haven’t been able to take care of the lien then you can also contact Gary with Gary Buys Houses. He has experience working with people like you who are stuck with a mountain of debt and a lien on your home. He will work with you to come up with a tailored solution to take care of the lien and start enjoying life with less stress and debt. Contact Gary today.